There’s no denying that COVID-19 has destroyed many people’s plans of travelling overseas this year. For Australians, there’s still no fixed date for when we’ll be allowed to fly outside of this country - and for some, even our own state.

The financial year ending June 2019 saw Australians make over 9.5 million overseas trips. Thanks to COVID, that number has dwindled, which means this year there’s a lot of people who now have extra cash as a result of having to cancel their overseas vacations.

Let’s say you’ve just had to cancel a one-month trip to Europe and you’d saved up to $10,000 to cover flights, accommodation and daily spending. You now have the opportunity to grow that $10,000. Depending on what option you choose, you could double or triple this amount with little effort.

If you're in the privileged position that you have some saved up money from a cancelled holiday, below are four ways you could invest it. Admittedly, none of these options are as fun as travelling around the world, eating the local cuisine and experiencing new cultures, but they do set you up to be more secure in the future.

Put this money towards a house deposit

$10,000 is a fantastic start or boost to any deposit savings. You now have a great foundation to build on. You could use the deposit for an investment property or a home to live in. Generally, property in Australia is seen as a safe investment and historically the returns have been great. The ASX/ Russell Investments 2018 Long-term Investing Report states Australian residential investment property averaged 8% in gross returns per annum over 10 years to December 2017.

If you already own a home, you could put the savings into an offset account attached to your home loan. This will offset the amount of debt you pay interest on.

Invest $10,000 into the share market

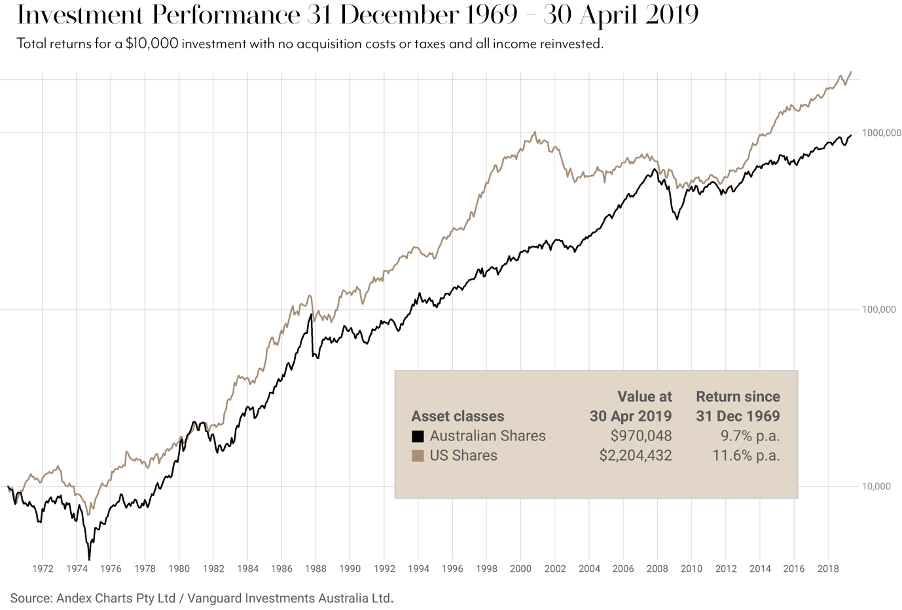

Investing in the share market can give you amazing returns if you commit for the very long term, as shown in the chart below: $10,000 invested in Australian shares in December 1969 grows to $870,048 by April 2019. If you invested the same money in US shares it would have grown to $2,204,432!* Imagine if you just did that only once in your lifetime, you’d have a small fortune down the track!

*This does not take into account fees and currency conversion and it is assumed all returns are re-invested.

Put the money into superannuation

You can boost your superannuation by adding your own contributions to your super fund.

Personal super contributions are the amounts you contribute to your super fund from your after-tax income (that is, from your take-home pay).

This is in addition to the compulsory contributions from your employer or any contributions made through a salary sacrifice arrangement. You may also claim a tax deduction on a personal contribution made with after tax dollars. But there’s a limit of $25,000 all up in one year.

For more information on this from the ATO, click here.

High interest rate savings account

If you can’t bear the thought of locking your savings into super, or you’re not feeling brave enough to dive into the share or property market, the best way you can nurture your savings is to put them in to a high interest rate savings account.

You can use comparison sites to research which bank or account type is offering the highest interest rate at the time. Make sure you look out for fees!

At the moment, Westpac is offering 3% variable interest on a savings account for people aged between 18-29 (T&C’s apply). If you are 18 and deposited your $10,000 into this account, and then contributed $100 every month for 10 years, your $10,000 would become $27,469. You can use this MoneySmart calculator to see how much interest you could accrue with how much you can afford to contribute to your savings.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.

This story was originally published on Tilly Money. Read more from Tilly Money like how to make your first stock trade or the difference between good and bad debt.