Talking money might traditionally be seen as taboo, but new data suggests now, more than ever, it's an uncomfortable conversation worth having — especially amongst women.

A recent study by Money.com.au found that, on average, women have $39,458 in savings — $14,486 less than men, who have $53,944. Put differently, women are a staggeringly 27% more financially vulnerable than men. Not only does this difference play out when it comes to hitting milestones like purchasing a home, but it also manifests day-to-day, with the survey finding two in five women (40%) struggle to save after paying their bills each month, compared to just a third of men (33%).

“The gender savings gap will make it harder for many women to build long-term financial security,” said Money.com.au’s Finance Expert, Sean Callery. “With less in the bank on average, women face more obstacles when it comes to qualifying for a home loan, investing, and preparing for retirement.”

Why do women have less money than men?

At the fore is the gender pay gap which, at the time of writing, sits somewhere between 11.5 and 21.7 per cent. As a result, according to the Australian Council of Trade Unions, women work for free, on average, for about 42 days per year.

But there's also hidden costs associated with being a woman — which some have dubbed the 'pink tax.' The pink tax was shown in action via research conducted by financial services provider AMP, which found that, on average, women pay 29% more for razors, 16% more for body wash, and 12% more for underwear when compared to men's products.

Perhaps most alarmingly, the gender savings gap continues well into retirement. In fact, according to Australian Ethical, the gender savings gap only becomes more pronounced as men and women approach retirement age, with lower income rates culminating in less superannuation. Generally speaking, if women have less super to invest, there are fewer returns to compound, leaving them with less money to retire on.

So, how do we normalise talking about money?

If you're struggling to make ends meet, you might feel inclined to keep your finances under wraps. But the key to developing financial resilience could actually be opening up.

Openly discussing your salary with friends and colleagues, for example, enhances your negotiating power when it comes to signing on to a new position, or asking for a promotion. Without this kind of information at hand, women are more inclined to undervalue their market rate, ending up with lower salaries than men in similar positions and, thus, furthering the gender pay gap.

There's also power to be had from being transparent about money-related topics with friends, from saving tactics to investment strategies. To help you prepare for these kinds of conversations, you might like first to do your own financial health check of sorts, using online tools like the MoneySmart budget planner. There's also plenty to be gleaned from social media resources like She's On The Money, and Aussie Debt Free Girl—these are great places to sense-check your financial habits, before dipping your toes into hard-to-have conversations.

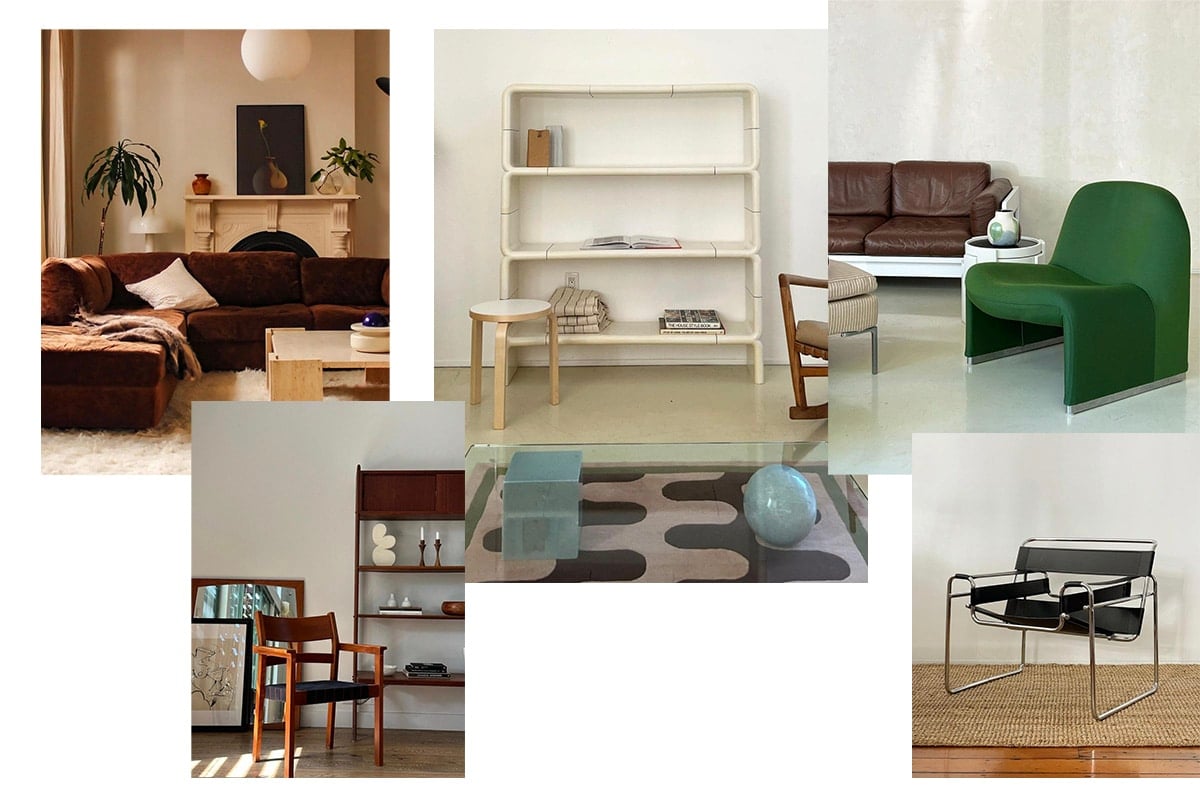

Feature image: Pinterest