Australians could be headed for major changes to the taxation rules around superannuation, under a comprehensive new proposal.

A new report by the Actuaries Institute has called for three major changes to the current system which it argues could save around $1 billion in fund operational costs – and also levelling the amount paid by employees and retirees. All the important details, including how it will impact your finances, below.

The proposed changes will impact how much tax we pay on super

The report proposes that all super should be taxed at 10 percent. This is a marked difference from the current system. Workers who are accumulating super currently pay 15 per cent, while those in retirement pay nothing.

“This would enable a simpler system where people could have just one super account, build stronger balances from when they begin working and save money on fees,” Actuaries Institute chief executive Elayne Grace said.

The proposed changes would also implement caps on how much superannuation you can withdraw

Another key proposal would attempt to stop retirees who game the superannuation system by withdrawing large amounts of money before submitting for an aged pension. The current system allows many retirees to claim a Government pension when they might not be entitled to one.

“The thresholds could be set at high levels, such as $250,000 and $150,000 per annum, respectively, with compensation for any retirees adversely impacted provided through adjustments to the age pension, for example,” the report read.

According to report author Jennifer Shaw, this would ensure super was used as intended, "to preserve savings to deliver income for a dignified retirement."

“They would leave the system largely unchanged for most retirees and still allow people to make large withdrawals for their immediate needs, for example paying off a mortgage or healthcare."

The report proposes removing the distinction between concessional and non-concessional super contributions

The third major proposal involves removing the option for tax-deductible contributions to your super fund. This proposal is aimed at reducing the number of wealthy individuals who could use this system as a loop hole for tax minimisation.

“Our proposals make super simpler for consumers and funds, while improving equity across the system," said report author Richard Dunn. "Further, the reforms encourage people to spend their super by removing the attraction of using super to accumulate tax-free bequests.”

Australia has one of the most complicated retirement schemes in the world

Ultimately, these proposals are designed to make the systems more equitable and easier to understand.

Removing or minimising some of the complexity of Australia's superannuation scheme could benefit minority groups, like women who have significantly less super than men and are increasingly retiring in poverty.

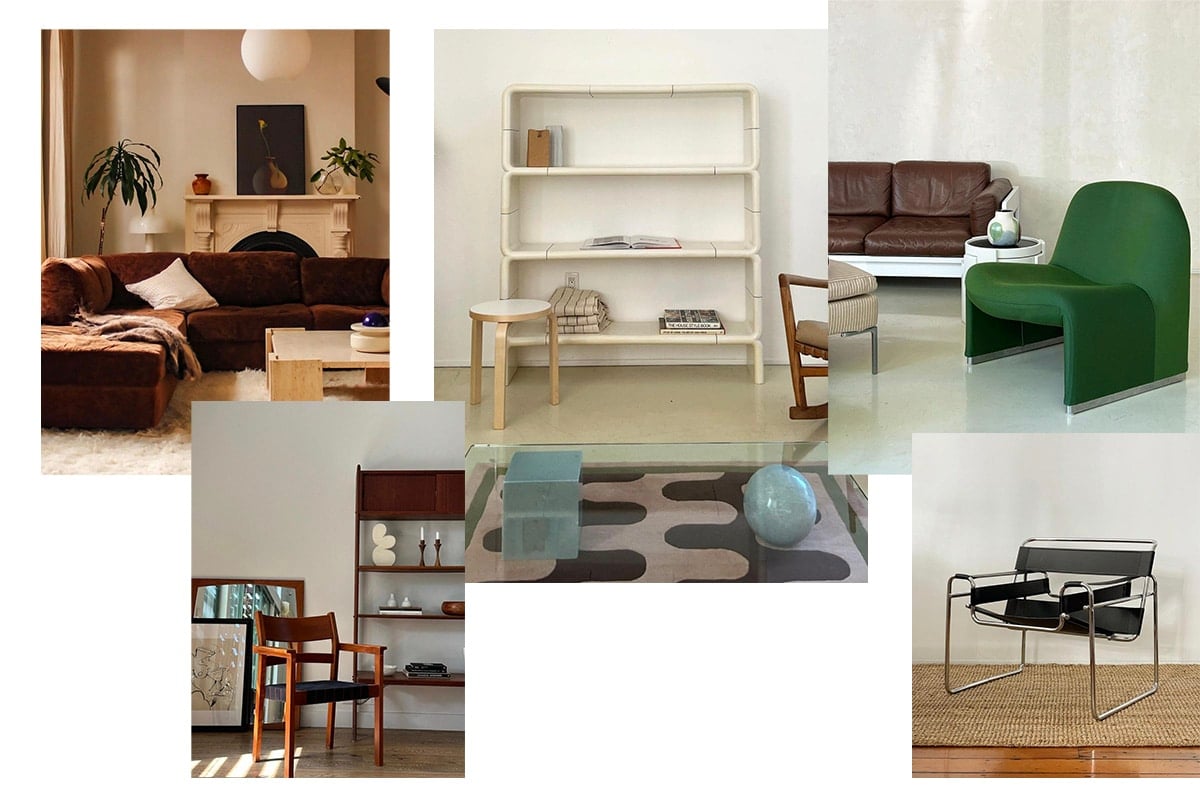

Feature image via Pinterest.